| |

I just saw a note to buy HDFC Ltd. For its fundamentals. ''Value Buy'' Now I have nothing against fundamentals. I do study them while making long term decisions. But that is also no reason to ignore the charts because they give us specific clues. HDFC is a loved stock for long. My mother wanted to buy it in 1992 and she did at 1200 [Rs.100 FV], because it is a good stock. I had no idea of fundamentals but it was the reason I started to draw a daily chart in my Graph book [sorry no computer programs back then].

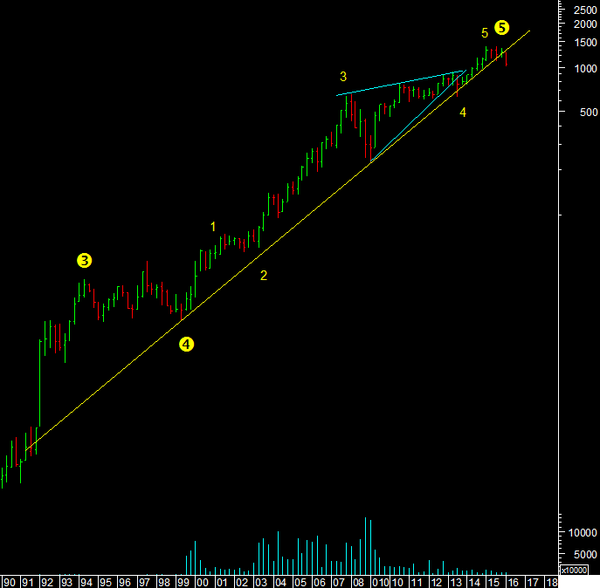

So the stock tripled and then went flat for 7 years. FIIs kept buying the whole time till they owned up whatever was permitted. Starting 1999 I saw the stock develop its first impulse wave and it has never looked back.

I know nice story, so here we are at the end of the 5th wave, wave 4 was a running triangle {yes it looked like a wedge initially}. But it wont matter longer term as you see we just broke a 15 year trendline on the stock. No this is not the end of HDFC it will be around for long I am sure. But trends are trends. Good stocks are often affected by market conditions and the current conditions are of a contraction in money and debt. This environment can have a negative impact on the valuations of the best and that is why cheap gets cheaper. It has nothing to do with fundamentals but Macro Economic factors. And right now it seams that is more important.

So I am not putting a target here but wave analysis holds that stocks can fall to wave 4 of the lower degree from where they rallied so going back to 632 is not a long shot in the dark. But I do not know if things will get worse or what lies ahead for the sector as this is a 15 year break not a normal garden variety correction and it is best to wait and watch before jumping the gun on Value buying your favourite stock. These are only my observations, do your own homework before you take any action.

|

| |

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ Rohit Srivastava www.indiacharts.comFor accurate market forecasting. Market forecasting is a study of past data to assess future probable outcomes. It is our endeavour to discuss high probability outcomes for traders and investors. However this is not a solicitation to buy or sell stocks futures or options or any security. Trading in any financial market should be done with sound knowledge and the help of a qualified investment adviser. Stocks based on the Elliott wave model are based on the Fibonacci fractal of the market and momentum indicators, Price levels are based on Fibonacci maths and are only indicative of what the mathematical model throws up. We may hold positions in the stocks/markets discussed and are interested in the views and opinions expressed. This is not a recommendation to buy/sell. ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ |

| |

I 305 Ekta Bhoomi Gardens

Dattapada Road Borivali East

Mumbai Maharashtra 400066

INDIA

--

CA. Rajesh Desai

--

You received this message because you are subscribed to the Google Groups "LONGTERMINVESTORSRESEARCH" group.

To unsubscribe from this group and stop receiving emails from it, send an email to

longterminvestorsresearch+unsubscribe@googlegroups.com.

Visit this group at

https://groups.google.com/group/longterminvestorsresearch.

For more options, visit

https://groups.google.com/d/optout.

No comments:

Post a Comment